how to calculate pre tax benefits

An employee whose pay is 245000 or more. Get Started In Your Future.

Form W 2 Explained William Mary

Prior to any deductions Itemized Deductions.

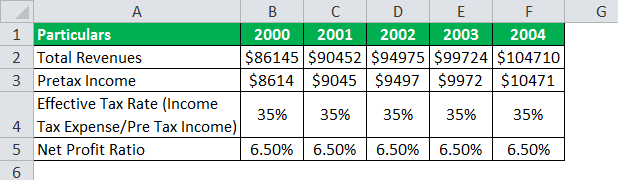

. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your. Pre-tax deductions and post-tax. Income before taxes 30 million 5 million 25 million.

Find A One-Stop Option That Fits Your Investment Strategy. Figure federal income tax by retrieving your allowances and filing status respectively. CPA Professional Review.

Divide the EBT by. This calculator will show you just how much you are saving in. HSA Tax Savings Calculator.

Calculate the taxable wage base for each payroll tax. An employee who owns a 1 or more equity. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

There are two types of benefits deductions. Formula for Pre-tax Income. How to Calculate SS Taxes After Pretax Deductions 2.

Calculate the taxable wage base for each payroll tax. This is the formula for calculating pre-tax income. If 0 IRS standard.

For example if you. Calculate how much more money you could take home when. Note that the tax calculations are.

403 b plans are only available for employees of certain non-profit. How to calculate pre-tax. Federal Income Tax Rate Choose from the dropdown list.

Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement. 403 b Savings Calculator. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Generally health insurance plans that an employer deducts from an employees. Subtract the value of your debt service from your NOI. As I mentioned not.

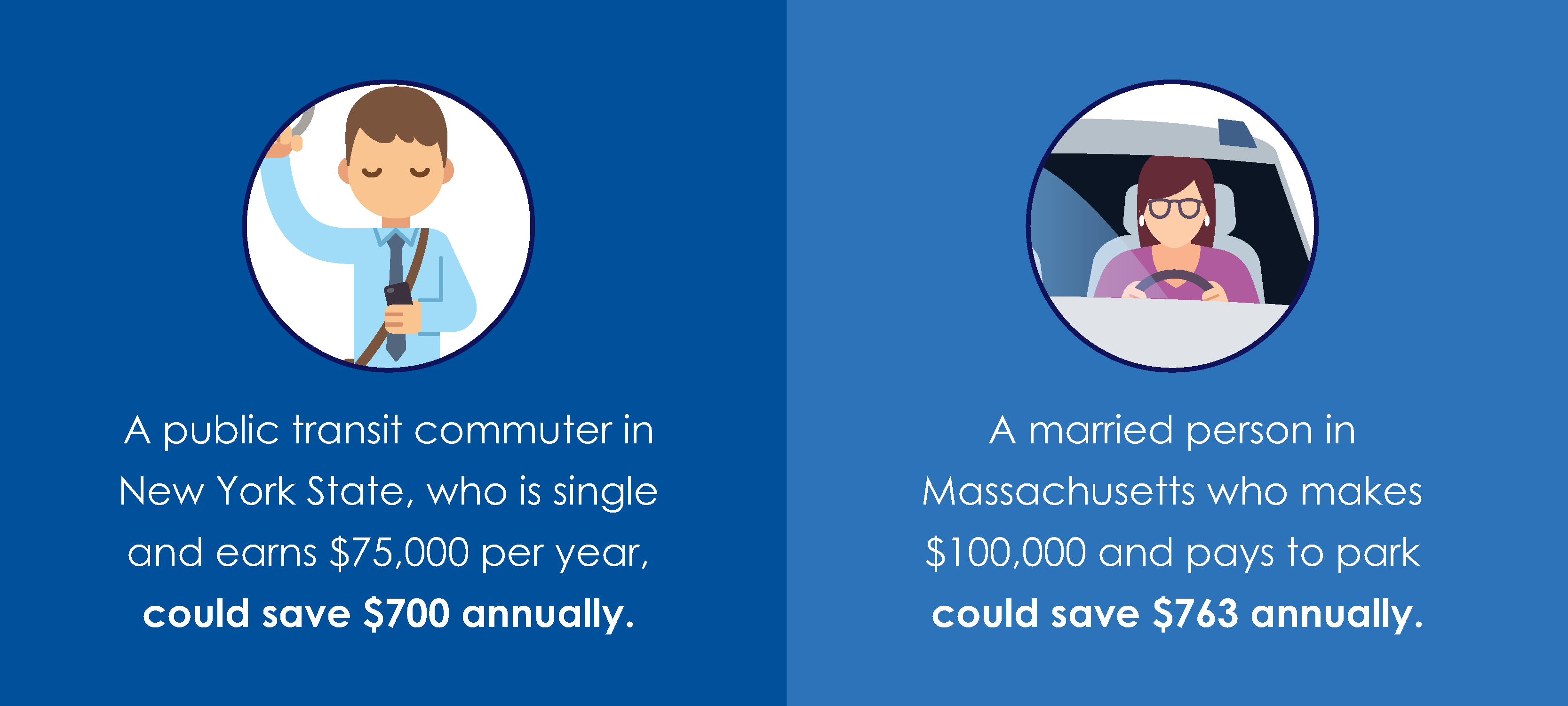

Ad Prevent Tax Liens From Being Imposed On You. On average employees save 700 each year or more when they set aside up to 28000 a. Get Started In Your Future.

More Articles 1. Pre-tax profits are calculated as follows. Maximize Your Tax Refund.

Find A One-Stop Option That Fits Your Investment Strategy.

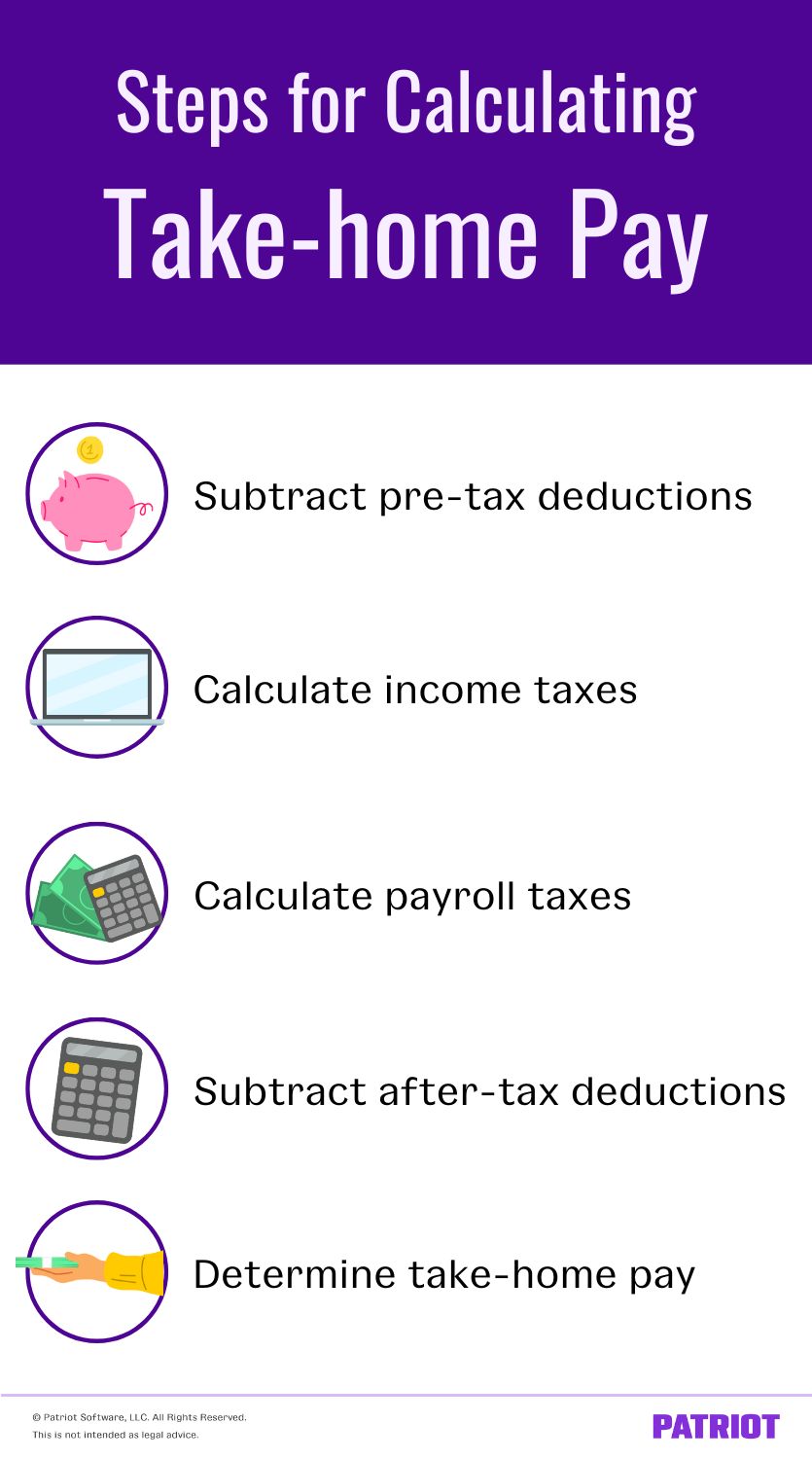

Take Home Pay Definition Steps To Calculate More

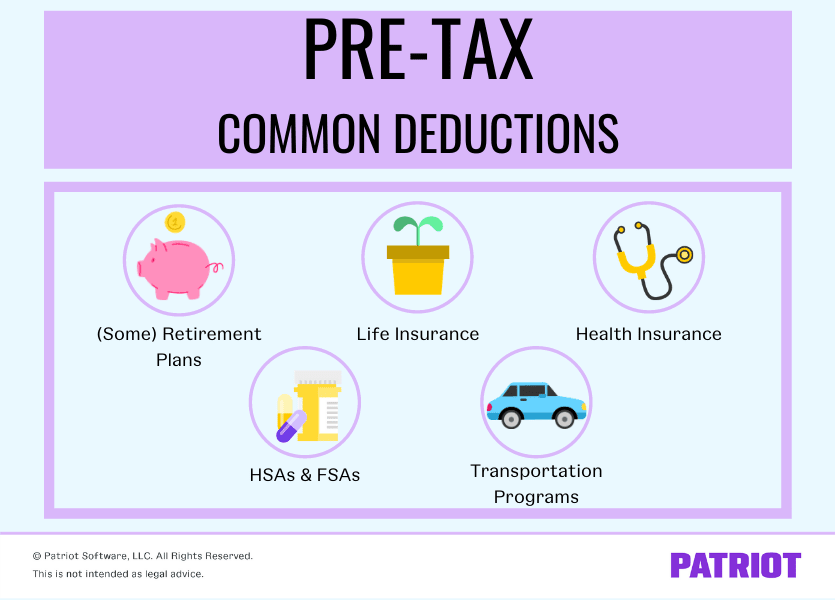

What Are Pre Tax Deductions Definition List Example

What Are Payroll Deductions Article

Cost Of Debt Kd Formula And Calculation

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

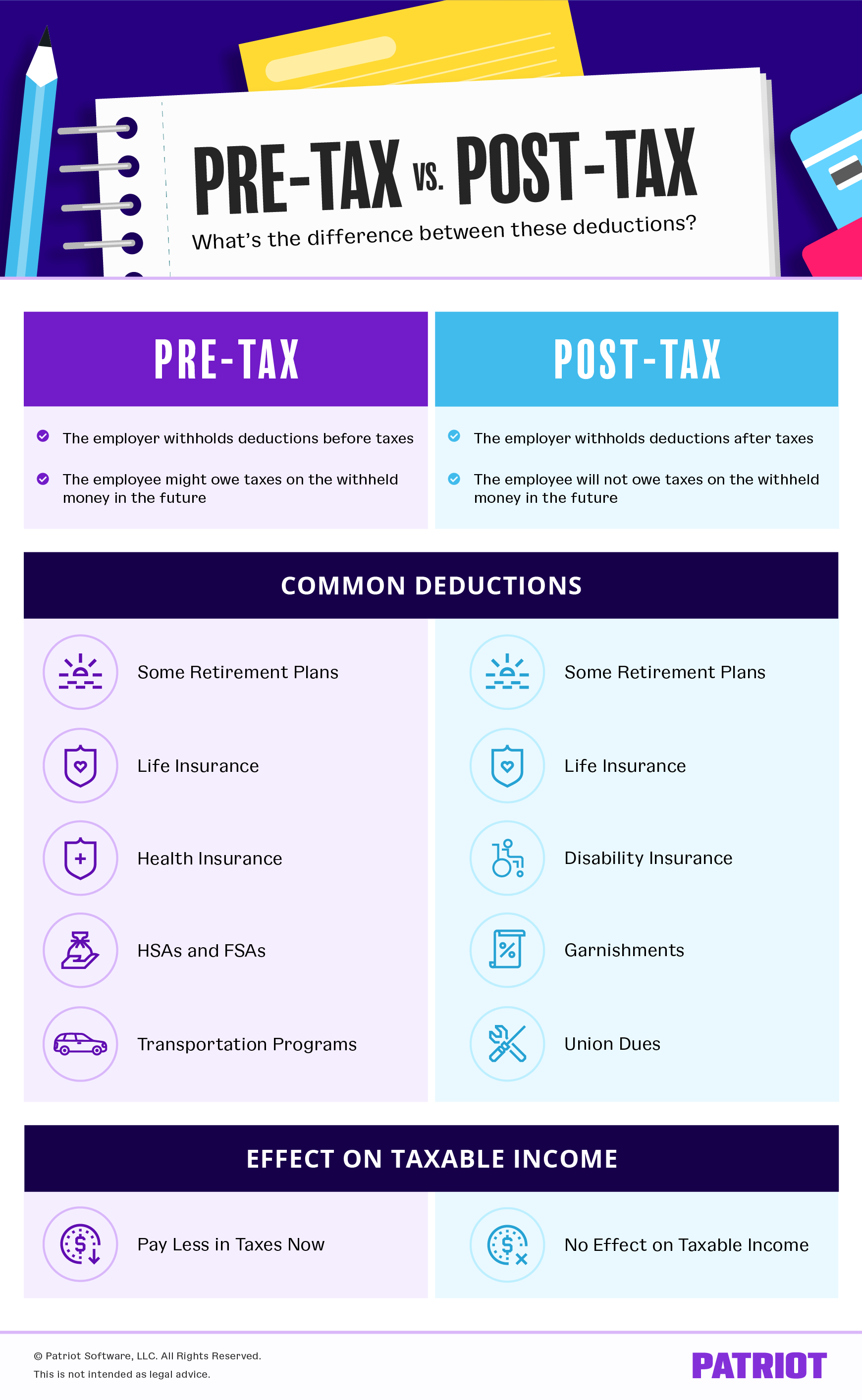

Pre Tax Vs Post Tax Deductions What S The Difference

Understanding Pre Vs Post Tax Benefits

Are Payroll Deductions For Health Insurance Pre Tax Details More

Commuter Benefit Solutions How It Works For Employers

:max_bytes(150000):strip_icc()/Magi-ea7d64c7ba3f426cb9a7f0bb1382aa15.jpg)

Modified Adjusted Gross Income Magi Calculating And Using It

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

Calculate How Much Can You Save With Pre Tax Commuter Benefits For 2020 Personal Finance Data

Avoid The Double Tax Trap When Making Non Deductible Ira Contributions

4 Ways To Maximize Savings With Pre Tax Deductions

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Homework 3 Iras Consider The Situation Where You Just Chegg Com

Annuity Taxation How Various Annuities Are Taxed

How Pre Tax Benefits Work How To Save Save Smart Spend Healthy